Selling Your Business is the Wrong Exit Strategy: The Cash Flow Exit Explained.

Most entrepreneurs build a business with one main goal: to achieve financial freedom. The conventional path to this goal is to labor for years, build the company, and then sell it in one massive, life-changing event.

I thought that way when I started. But after ten years of building my business, I learned there was a less risky, more lucrative path that delivered immediate financial freedom. This powerful lesson hit home the moment another company offered to buy my business.

I want to share my core learning: Selling your business to someone else should be considered a bonus exit strategy, not your default path to financial freedom.

The strategy I used is what I call the “Cash Flow Exit”—where you “Sell Your Business to Yourself.” This approach allowed me to achieve financial freedom quicker and with less risk while I was still operating my business. Even better, it set up a "bonus sale" to a strategic buyer later on, allowing me to exit the business and more than quadruple my original financial freedom goal.

The Private Equity Playbook: Why You Should Adopt It

When a Private Equity (PE) firm or another company acquires a business, they use various strategies to recoup their investment, typically within the initial 3-5 years.

One of their core strategies is simple: They use the business's cash flow to pay back their debt or investors.

As a business owner, you play two roles: an employee (if you have an operational role) and an investor (as the main owner or with limited partners). My premise is that as an investor and shareholder, you should act just like a Private Equity company. Use the cash flow of your company to effectively sell your company to yourself—what I call the “Cash Flow Exit.”

5 Must-Haves for a Successful Cash Flow Exit

To successfully execute this strategy, your business needs to meet a few foundational conditions:

You Are Past the Startup Haze: Your business is established, proven in the market, and out of the initial forming stages.

Operating Capital is King: You have saved and maintain enough operating capital in the business to run it smoothly. (Tip: Use industry benchmarks to set the right amount.)

No Venture or Investor Handcuffs: You are not a venture or investor-backed company. For those partners, a traditional exit is usually preferred, which adds significant complexity and control issues.

Pay Yourself a Market Wage: If you work in the business (CEO, Founder, etc.), you must pay yourself a market wage for that role. This salary should support your lifestyle, so you're not tempted to live off the investor distributions.

Solid Profitability (EBITDA): You have solid operating margins (10-20%). If you don’t, it's a sign that something is off, and you may not be ready to "sell to yourself."

Picking Your Financial Freedom Number

Now for the exciting part: determining your financial freedom number. This could be what you envision selling the company for one day, or your retirement goal.

I recommend having two goals: a lower number focused on maintaining your current lifestyle and a high number that represents your stretch goal.

With your financial freedom number set, I'll walk you through how the Cash Flow Exit works—and why it’s the quickest, most effective, and least risky path.

The Core Premise: Double Compounding Your Wealth

The main premise of the Cash Flow Exit is this: once you have the appropriate operating capital in place, you—the investor—will take your business profits (EBITDA) and cash flow them into a personal investment account on a quarterly basis.

Shareholder-based companies consistently send out profits or dividends to their investors. As the main investor, you do the same for yourself, effectively "selling the business to you.

"Case Study: Cash Flow Exit vs. Traditional Sale

Let’s run a typical scenario using the calculator I built for this strategy.

You can run your own scenario or see the full analysis from this default scenario by clicking the button below.

Business Snapshot

| Metric | Value | Notes |

|---|---|---|

| Revenue | $1 Million | A solid target out of startup mode. |

| EBITDA | 15% | A well-run company is typically in the 10-20% range. |

| Sales Growth | 10% | Achievable, solid growth rate. |

| Valuation | 5X EBITDA | A common valuation multiple. |

Personal Snapshot

| Metric | Value | Notes |

|---|---|---|

| Financial Freedom Goal | $3 Million | Provides $120k/year in retirement (using the 4% rule). |

| Current Savings | $200,000 | Represents some initial savings or investment. |

| Annual Contributions | $12,000 | Annual 401k or spouse contribution. |

| Portfolio Return | 7% | A balanced, non-aggressive return rate. |

| Average Tax Rate | 20% | Adjust for your situation. |

The Results: Prepare to Be Wowed

Conventional thinking says the fastest way to hit your $3 million goal is to work tirelessly, build the business, and sell it. For me, that path always felt nebulous, risky, and like a continuous grind toward an elusive future date.

I’m here to tell you that selling your business to someone else is the slowest, riskiest, and most financially stressful way to achieve financial freedom.

Here is the proof:

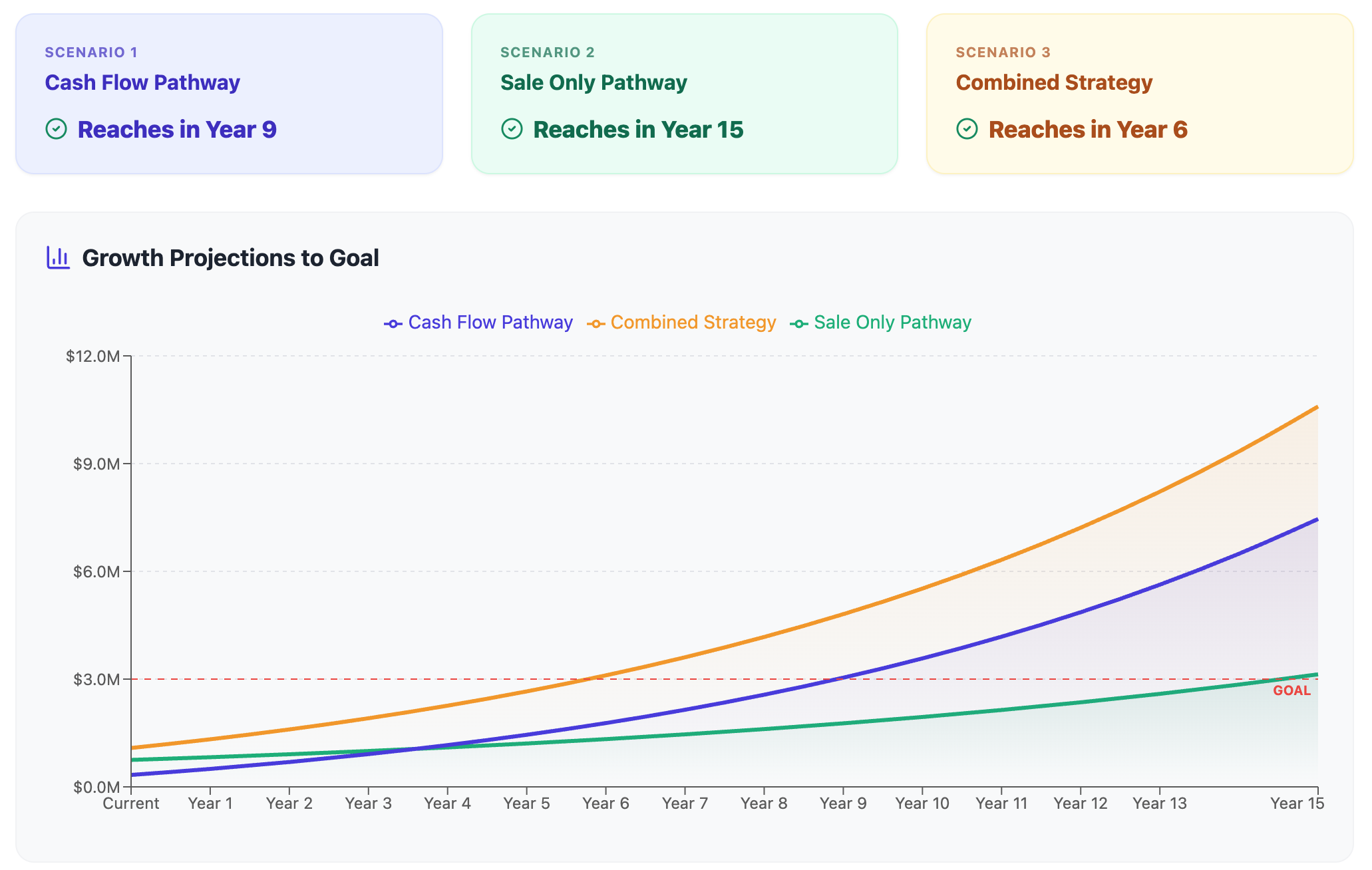

The "Sale Only Pathway" (Traditional Thinking): Takes 15 years to reach the $3 Million goal.

The "Cash Flow Exit" (Selling to Yourself): Takes only 9 years—6 years less than the traditional path!

Imagine: You could work 6 years less and hit your financial freedom goal.

The Ultimate Combined Strategy: Sell to Yourself, Then Sell to a Buyer

The most powerful strategy is the combination: Cash Flowing your business to yourself and then selling to someone else.

The Combined Strategy: Takes only 6 years—9 years less than the "Sale Only" path!

What Happens When You Cash Flow for 9 Years and THEN Sell?

Let's look at the power of the Cash Flow Exit at the 9-year mark, when you’ve already achieved your $3 million goal by paying yourself.

If you then sell your business to an outside buyer in Year 9, you would have $4,808,314.

You effectively sold your business twice:

First Sale (To You): $3,000,000 (Already in the bank)

Second Sale (To Buyer): $1,808,314 (Based on the Year 9 valuation)

You've achieved your original goal and hit a massive stretch goal. Are you still waiting until Year 15 to only make $3 million?

The Staggering Difference at Year 15

What if you simply continue to operate your business and use the Cash Flow strategy all the way to Year 15?

Cash Flow Strategy (Operating Business): You would have $7,457,700.

Sale Only Strategy (Year 15 Valuation): You would have $3,000,000 (your goal amount in the first year the valuation exceeds it).

By using the conventional "Sale Only" thinking, you would have left $4.4 million on the table for the same amount of hard work.

What if you then sell your business in Year 15 to another buyer:

Combined Strategy (Year 15 Valuation): You would have $10,590,636.

You could pocket another $3,132,936 (over 3X your original goal) effectively selling your business twice.

5 Reasons the Cash Flow Exit is Superior

The strategy of selling your business to yourself first, and then having the bonus of a sale to an outside buyer, is always more lucrative, faster, and less risky. Here’s why:

1. 100% Control: You Drive the Exit

You rely on no one but yourself and your team's ability to execute. You are not dependent on industry valuations, market conditions, or the whims of a potential buyer. As long as you run a solid business, this path works.

2. Faster De-Risking

The sooner you achieve financial freedom (Year 9 vs. Year 15), the sooner you "de-risk" yourself from the inevitable shocks of recessions, industry shifts, and operational issues. If you choose to continue running the business, you do so from a place of financial security.

3. Always Ready for a Premium Sale

By committing to the Cash Flow Exit, you are forced to keep your business in peak shape for distributions. This inherently makes you always prepared for an optimal sale to someone else, maximizing your valuation when that opportunity arises.

4. The Power of Double Compounding

This strategy works because of the compounding impact of taking distributions and investing them. You are no longer solely counting on the sales growth of the business to reach your goal. You are compounding the profits as an investor and compounding the value of the business growth. This is the most powerful financial reason to own a business.

5. Freedom Now, Not Later

The stress of running a business is real. This strategy shifts you out of a scarcity mentality ("I have to grind until I can sell to be free") and into an abundance mindset. Your freedom is built quarterly and yearly with every distribution.

Final Word: Stop Making Excuses

I know the excuses roll in:

"My business doesn't cashflow enough for me to do this."

"I need my profits to operate the company and grow faster."

"I'm okay taking a lower salary so the business valuation is higher later."

Here is the hard reality: If your business cannot cash flow out to you, it will likely not sell at a valuation that achieves your financial freedom number.

The human tendency is to inject limiting beliefs into our unique situations. I had those too. But once I made a plan and started practicing this shift, those beliefs dissolved, and my path to financial freedom opened up. This was a life-changing shift for me, and it can be for you as well.